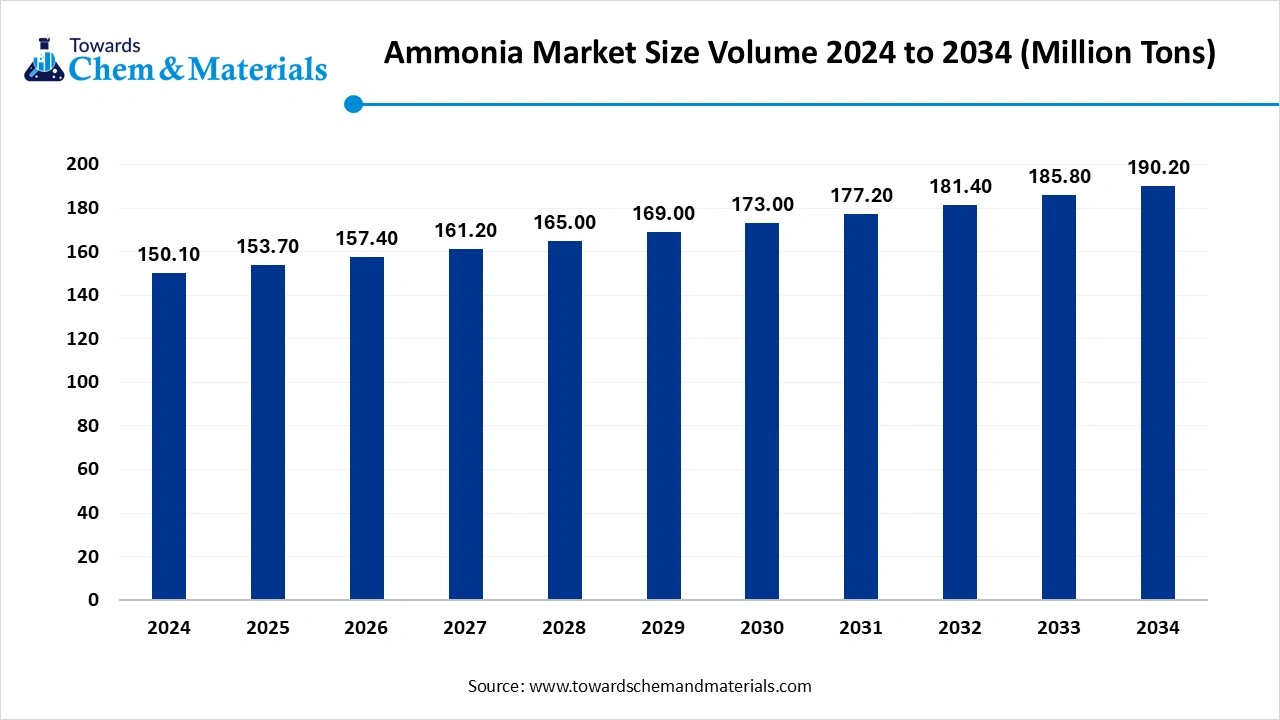

Ammonia Market Size Volume to Reach 190.20 Million Tons By 2034

According to Towards Chem and Materials consultants, the global Ammonia market Volume demand stood is expected to reach 153.70 million tons in 2025 to 190.20 million tons by 2034 and continue to grow at a remarkable CAGR of 2.40 % during the forecast period until 2034

Ottawa, July 01, 2025 (GLOBE NEWSWIRE) -- The Ammonia market Volume is predicted to grow from 150.10 million tons in 2024 to 190.20 million tons by 2034, driven by a CAGR of 2.40% A study published by Towards chem and Materials a sister firm of Precedence Research.

The ammonia market is witnessing growth driven by its critical role in green hydrogen production, increasing agricultural demand, and expanding industrial decarbonization initiatives globally. Ammonia (NH₃) is an important industrial chemical, and is generated most often through the Haber - Bosch process using natural gas or coal as feedstock. Fertilizers comprise more than two-thirds of ammonia applications globally; however, the ammonia market is currently primed for growth, with new applications in clean and renewable energy and decarbonization. Food security continues to drive fertilizer production, especially in agricultural economies; however, the global narrative is now shifting towards low-carbon or net-zero ammonia.

Get All the Details in Our Solutions –Download Sample: https://www.towardschemandmaterials.com/download-sample/5522

The ammonia market is at an emerging inflection point with increased interest in green ammonia (using renewable power via electrolysis to produce ammonia). This is not only environmental; constituents of the ammonia value chain are increasingly emphasizing economic transition, as long-term production economics are now being reshaped by global carbon pricing and sustainability mandates. Multiple pilots and infrastructure developments, mainly in Europe and Asia, point to ammonia being repurposed and positioned as the fuel and hydrogen carrier of the future, elevating ammonia industry relevance across both verticals and emerging markets.

Uses of ammonia Market

The major use of ammonia is as a fertilizer. In the United States, it is usually applied directly to the soil from tanks containing the liquefied gas. The ammonia can also be in the form of ammonium salts, such as ammonium nitrate, NH4NO3, ammonium sulfate, (NH4)2SO4, and various ammonium phosphates. Urea, (H2N)2C=O, is the most commonly used source of nitrogen for fertilizer worldwide. Ammonia is also used in the manufacture of commercial explosives (e.g., trinitrotoluene [TNT], nitroglycerin, and nitrocellulose).

In the textile industry, ammonia is used in the manufacture of synthetic fibres, such as nylon and rayon. In addition, it is employed in the dyeing and scouring of cotton, wool, and silk. Ammonia serves as a catalyst in the production of some synthetic resins. More important, it neutralizes acidic by-products of petroleum refining, and in the rubber industry it prevents the coagulation of raw latex during transportation from plantation to factory. Ammonia also finds application in both the ammonia-soda process (also called the Solvay process), a widely used method for producing soda ash, and the Ostwald process, a method for converting ammonia into nitric acid.

Ammonia is used in various metallurgical processes, including the nitriding of alloy sheets to harden their surfaces. Because ammonia can be decomposed easily to yield hydrogen, it is a convenient portable source of atomic hydrogen for welding. In addition, ammonia can absorb substantial amounts of heat from its surroundings (i.e., one gram of ammonia absorbs 327 calories of heat), which makes it useful as a coolant in refrigeration and air-conditioning equipment. Finally, among its minor uses is inclusion in certain household cleansing agents.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5522

Ammonia hazard information

| Hazard class* | Hazard statement | |

| Gases under pressure, liquefied gas | H280—Contains gas under pressure; may explode if heated |  |

| Skin corrosion/irritation, category 1B | H314—Causes severe skin burns |  |

| Serious eye damage/eye irritation, category 1 | H318—Causes serious eye damage |  |

| Acute toxicity, inhalation, category 3 | H331—Toxic if inhaled |  |

| Hazardous to the aquatic environment, acute hazard, category 1 | H400—Very toxic to aquatic life |  |

| Hazardous to the aquatic environment, long-term hazard, category 2 | H411—Toxic to aquatic life with long-lasting effects |  |

Explore Strategic Figures & Forecasts – Access the Databook | Immediate Delivery Available: https://www.towardschemandmaterials.com/download-databook/5522

Absent a change in course, ammonia production would continue to take an environmental toll

The industry’s current trajectory is unsustainable. In the Stated Policies Scenario, ammonia production increases by nearly 40% by 2050, driven by economic and population growth. CO2 emissions grow by 4% by 2034, before entering a decline that is mainly spurred by increases in energy efficiency and a decline in the proportion of coal use. In 2050, emissions are 10% lower than today. Cumulative direct emissions from ammonia production under current trends amount to around 28 Gt between now and 2100, equivalent to 6% of the remaining emissions budget associated with limiting global warming to 1.5 °C.

Existing assets give the industry’s emissions momentum. Ammonia production facilities have long lifetimes of up to 50 years. The current average age of installed capacity is around 25 years since first installation, but this figure is subject to significant regional variation. Plants in Europe are around 40 years old on average, compared with 12 years in China, which is home to around 30% of global capacity. Depending how long these plants operate, the existing global stock could produce up to 15.5 Gt CO2 over their remaining lifetime, which is the equivalent of 35 years’ worth of ammonia production emissions in 2020.

What are the Major Trends in the Ammonia Market?

- Move towards green ammonia generation- There are rapid investments from governments and industry surrounding green ammonia, which is renewable electricity and electrolysis. This movement aligns with carbon reduction obligations as well as expanding ammonia's utility as a clean energy carrier, specifically for export and maritime fuel uses.

- Increased use of ammonia for the hydrogen economy- Ammonia is beginning to emerge as a main hydrogen carrier due to its properties that make storage and transportation easier. Energy-importing countries are investigating ammonia as a vehicle for importing hydrogen, especially in Asia and Europe which are experiencing rapid hydrogen demand expansion.

- Decarbonization of fertilizer producers- Fertilizer producers is adopting low-carbon technologies and carbon capture to decarbonize ammonia production. This shift to low-carbon proposals is connecting to regulatory pressures, ESG mandates, and demand for sustainably sourced agricultural inputs.

How Artificial Intelligence Powering the Next Green Revolution in the Ammonia Industry?

Artificial intelligence is changing the ammonia sector by advancing productivity, sustainability, and operational intelligence. In 2024, researchers created an AI-driven catalyst discovery platform, combining machine learning and real-time data to synthesize ammonia at a faster rate and improved efficiency with milder conditions. AI will continue to improve green ammonia projects, such as optimizing operations of electrolysers and renewable energy mix.

Businesses such as Yara and Siemens have utilized smart systems to reduce production wastage, while enhancing their environmental performance. As its development continues, AI is now positioned to transform the role of ammonia in the global decarbonization of fuels by making it smarter, cleaner, and better suited to future energy needs.

How Is Ammonia Emerging as a Key Enabler in the Future of Clean Energy and Industry?

The ammonia market is entering a growth phase, especially in clean energy and in industrial process applications. While ammonia is traditionally viewed in the context of agricultural applications, it is gaining traction as a hydrogen carrier and carbon-free fuel alternative. For example, the government in South Korea’s KEPCO plans to co-fire 20% ammonia in coal power plants by 2030, this is reflected as a way for industries to reduce emissions by not changing their existing systems.

Technological innovations are contributing positively to the ongoing and future growth of the ammonia market. The development of situated solid oxide electrolysis and mobile green ammonia plants are examples of looking at neighbourhood and low-cost production, in addition to traditional approaches. As industries begin to plan for decarbonizing hard-to-abate sectors such as shipping, mining, and heavy manufacturing, ammonia emerges as a flexible and investable solution which can render futuristic energy and industry a strategic enabler.

What Can be the Potential Barriers Limiting the Future Growth of Ammonia Market?

- High Carbon Footprint and Regulation Pressure- The production of ammonia is an energy-intensive process that generates significant carbon dioxide emissions, which poses a challenge for the environment on a global scale. As governments ramp up climate action, regulatory frameworks are also tightening. For instance, the European Union activated its Carbon Border Adjustment Mechanism (CBAM) in May 2023, introducing carbon tariffs to ammonia exporters on high emissions imports, reducing the feasibility for producers to rely on traditional production methods.

- Reliance on a Volatile Natural Gas Market- The ammonia industry's reliance on natural gas as a feedstock ties the industry to potentially volatile and unpredictable price and supply issues. Europe’s natural gas demand for electricity generation continued to decrease in 2024, falling by 8%, resulting from an already strained supply of LNG and geopolitical tension. As a result, major producers, such as BASF and Yara International, had to scale back production, demonstrating the industry's sensitivity to the energy market.

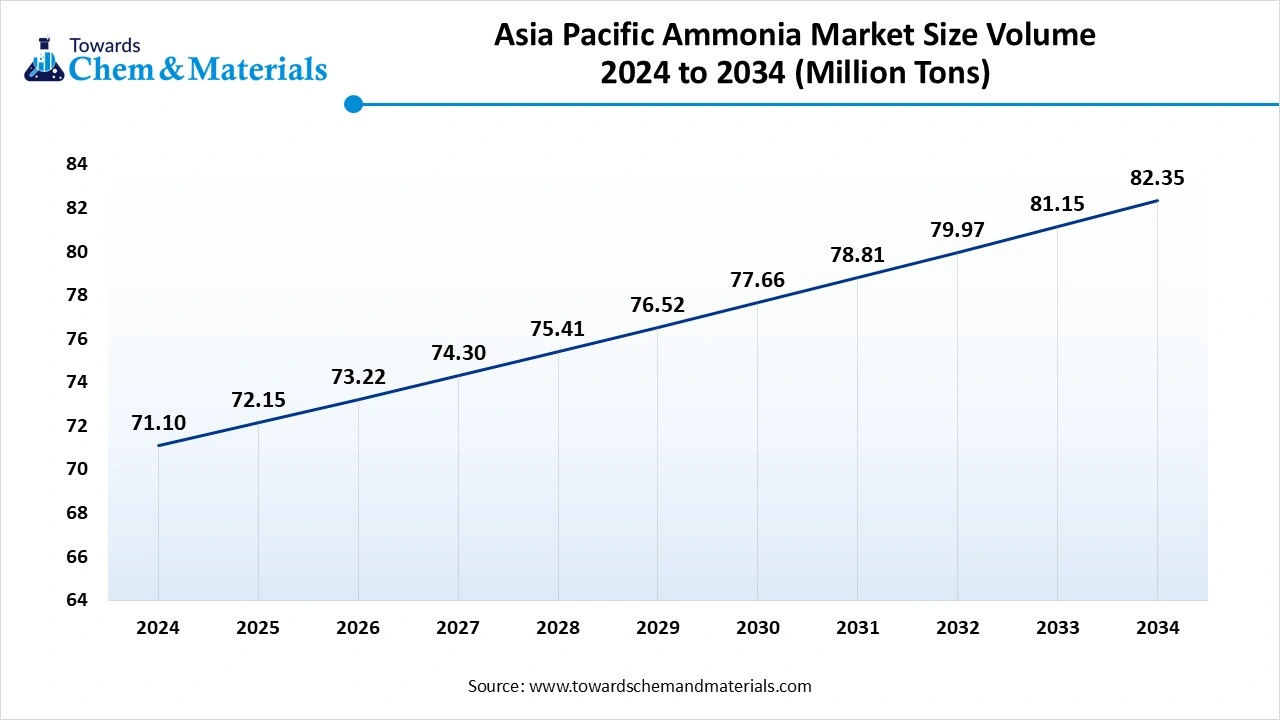

What makes Asia Pacific the Global Hub for Ammonia Production and Green transition?

Asia Pacific holds a commanding position in the global ammonia market in 2024, due to the vast agricultural needs of the region and rising clean energy agendas. The region has a much larger total fertilizer demand, because many of the most populous countries are in Asia Pacific. China and India absorb a large global share of ammonia production and use.

-

In February 2024, India's massive new green ammonia investment initiative (under the SIGHT programme) (532,000 tons renewable ammonia subsidy production) exemplifies the region's transition toward decarbonized ammonia delivery in agriculture and energy applications.

Invest in Premium Global Insights Immediate Delivery Available @ https://www.towardschemandmaterials.com/price/5522

Why is China the Largest Country in Asia Pacific?

The Asia Pacific ammonia market is expected to increase from Volume 72.15 million tons in 2025 to Volume 82.35 million tons by 2034, growing at a CAGR of 1.48% throughout the forecast period from 2025 to 2034.

China is the largest ammonia producer in Asia Pacific due to the breadth of its industrial base, significant demand for fertilizers, and ability to produce at scale. China also is still expected to be the largest overall producer of ammonia in the world around 43 million tons per year. The Chinese government continues to invest in its ammonia production modernization, and has started projects in conjunction with green ammonia fitting into a larger national hydrogen strategy. With high ag coverage and more and more green ammonia investment occurring across the country, there does not appear to be any stopping its position as the only key player in the regional market.

How is North America Becoming a Fastest Growing Area in the Ammonia Market?

North America expects the significant growth in the ammonia market during the forecast period, because of strong government backing for decarbonization, and clean energy. Investments in green and blue ammonia are to be supported with increasingly productive infrastructure. A growing emphasis has been placed on reducing industrial emissions, and supporting the development of clean fuels in agriculture, shipping and power sectors.

Ammonia Market Volume Share, By Region, 2024 (%)

| By Region | Market Volume Share, 2024 (%) | Market Volume- 2024 (Million Tons ) | Market Volume Share, 2034 (%) | Market Volume- 2034 (Million Tons ) | CAGR(2025 - 2034) | |||

| Asia Pacific | 47.36 | % | 71.1 | 43.29 | % | 82.3 | 1.48 | % |

| North America | 18.21 | % | 27.3 | 16.50 | % | 31.4 | 1.39 | % |

| Europe | 15.30 | % | 23.0 | 17.21 | % | 32.7 | 3.61 | % |

| South America | 10.01 | % | 15.0 | 9.50 | % | 18.1 | 1.86 | % |

| Middle East & Africa | 9.12 | % | 13.7 | 13.50 | % | 25.7 | 6.49 | % |

Why Is The U.S Household Leading Growth in North American Ammonia?

The United States is in the lead because of high-level public-private co-operative projects, and the amount of financing flowing into projects. For Instance, In September 2024, The U.S. Department of Energy (DOE) has offered $1.56 billion loan from the U.S. Department of Energy for a low-emission ammonia plant in Indiana. Companies such as CF Industries, and OCI Global, are expanding existing and new green ammonia facilities that will serve agriculture and domestic use and ultimately overseas export markets. The projects in the U.S. suggest the U.S government is strategically generally focused on becoming a world leader, and manufacturing hub for clean ammonia.

You can place an order or ask any questions, please feel free to contact at sales@towardschemandmaterials.com| +1 804 441 9344

Top exporters of Anhydrous Ammonia (2024)

| Countries | Trade Value 1000USD | Quantity Exported |

| Trinidad and Tobago | 1,255,980.28 | 2,771,100,000 |

| Canada | 736,574.17 | 1,081,130,000 |

| United States | 328,774.72 | 1,035,870,000 |

| Netherlands | 273,725.17 | 498,436,000 |

| Germany | 263,984.66 | 476,661,000 |

| Egypt, Arab Rep. | 210,720.75 | 348,598,000 |

| Malaysia | 163,613.86 | 457,319,000 |

| Turkey | 119,131.20 | 247,676,000 |

| Australia | 109,936.36 | 320,998,000 |

Join now to access the latest Chemical Industry segmentation insights with our Annual Membership: https://www.towardschemandmaterials.com/get-an-annual-membership

Ammonia Market Segmentation Analysis:

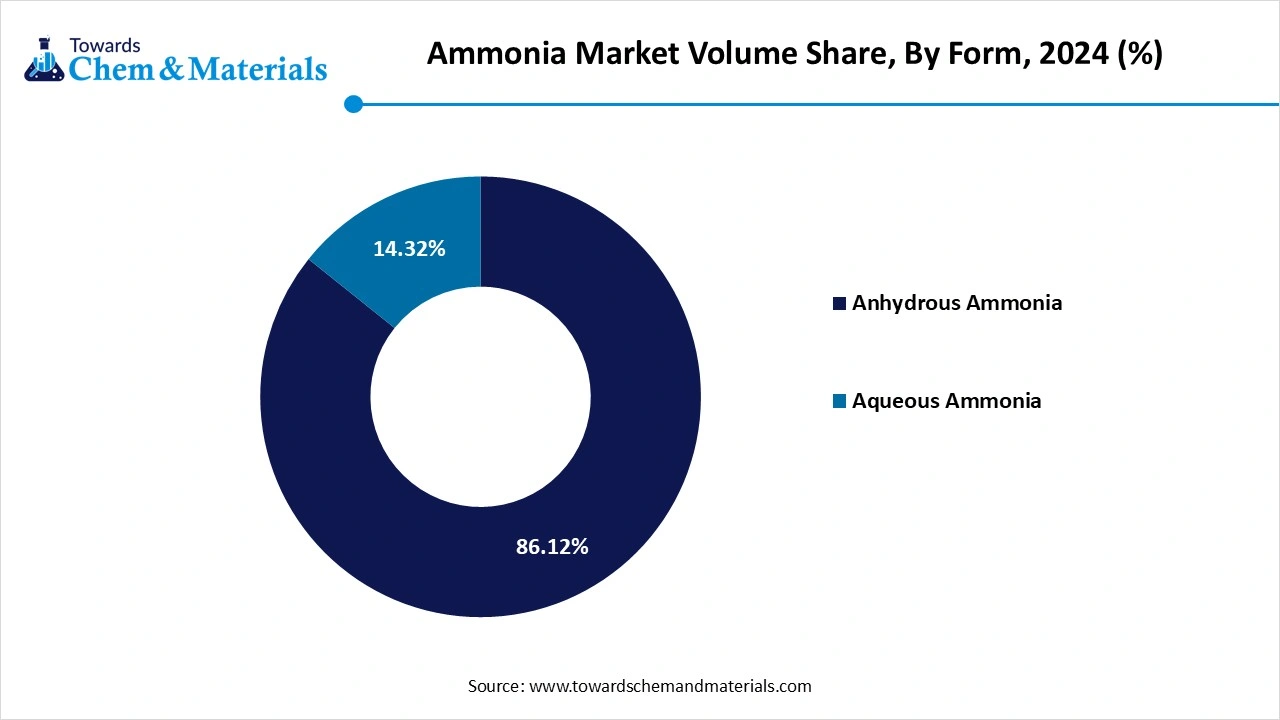

By Form Insights

What made Anhydrous Ammonia the Dominant Segment in the Ammonia Market in 2024?

Anhydrous segment dominated the ammonia market in 2024. Anhydrous ammonia is the most common form used in agriculture because of its high nitrogen content and relatively low cost. On a large scale, Anhydrous ammonia is the preferred form of nitrogen fertilizer in agriculture, used in large farming operations, particularly in the U.S., China, and Brazil. Anhydrous ammonia also requires little water, which leads to more storage and shipping capacity when transported. Given these advantages, anhydrous ammonia tends to be the favored form in industrial and agrchemical applications.

Aqueous segment expects the fastest growth in the market during the forecast period. Aqueous ammonia is fast becoming popular due to its safer handling and use properties, as well as its increased application for water treatment and pollution control. Industries across Europe and Asia face increased environmental compliance, which has led to the wider use and implementation of aqueous solutions for applications including neutralization, pH controlling, and scrubbing. The municipal wastewater treatment facilities, particularly concerning ammonia treatment, are using aqueous ammonia more frequently, and the seamless adoption of ammonia use in automated processes is attractive with even more dirt on their hands.

Ammonia Market Volume Share, By Form, 2024-2034 (%)

| By Form | Volume Share, 2024 (%) | Market Volume- 2024 (Million Tons ) | Volume Share, 2034 (%) | Market Volume- 2034 (Million Tons ) | CAGR(2025 - 2034) | |||

| Anhydrous Ammonia | 86.12 | % | 129.3 | 82.23 | % | 156.4 | 1.92 | % |

| Aqueous Ammonia | 14.32 | % | 21.5 | 18.21 | % | 34.6 | 4.89 | % |

Application Insights

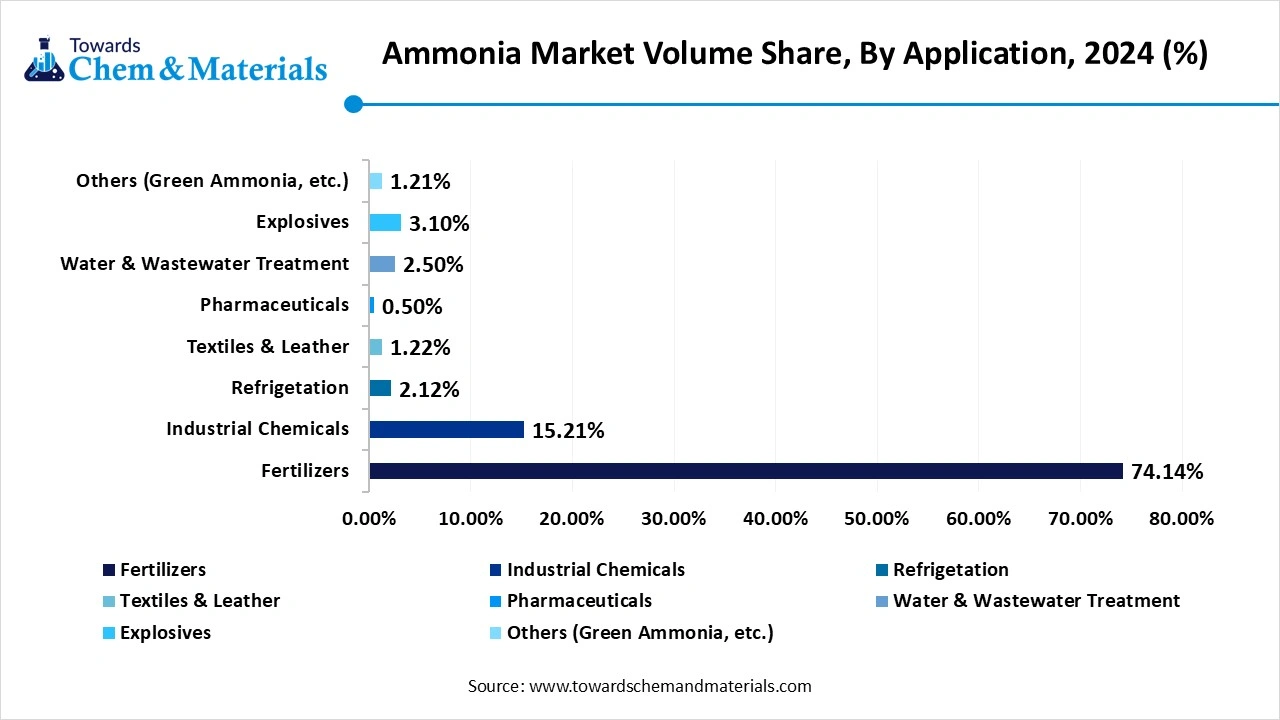

Which Application Segment Dominates the Ammonia Market in 2024?

The fertilizers segment dominated the market in 2024. Fertilizer is the most dominating application segment, mostly used in production, namely urea, ammonium nitrate, and ammonium sulfate. With global food demand rising and available farmland diminishing, nations must ramp up agricultural yields with the help of nitrogenous fertilizers. Countries like China and India are particularly reliant on ammonia to maintain their intensive farming methods. Additional to good agricultural policies and subsidies, food security is helping to maintain this dominant segment.

The refrigerants segment expects the fastest growth in the market during the forecast period, because of its zero ozone depletion potential, extreme thermal conductivity, and extremely high thermodynamic performance. With a global focus on phase-out of hydrofluorocarbon-based refrigerants (HFCs), ammonia is being used increasingly in cold chain logistics for processing, storage, and transportation of food, pharmaceuticals, and beverages. Increasing use in cooling data centers and other large-scale logistics infrastructure is leading to heightened awareness across modern supply chains.

Ammonia Market Volume Share, By Application, 2024 (%)

| By Application | Market Volume Share, 2024 (%) | Market Volume- 2024 (Million Tons ) | Market Volume Share, 2034 (%) | Market Volume- 2034 (Million Tons ) | Market CAGR(2025 - 2034) | |||

| Fertilizers | 74.14 | % | 111.3 | 70.55 | % | 134.2 | 1.89 | % |

| Industrial Chemicals | 15.21 | % | 22.8 | 14.32 | % | 27.2 | 1.78 | % |

| Refrigetation | 2.12 | % | 3.2 | 1.90 | % | 3.6 | 1.28 | % |

| Textiles & Leather | 1.22 | % | 1.8 | 1.01 | % | 1.9 | 0.48 | % |

| Pharmaceuticals | 0.50 | % | 0.8 | 0.50 | % | 1.0 | 2.40 | % |

| Water & Wastewater Treatment | 2.50 | % | 3.8 | 4.01 | % | 7.6 | 7.35 | % |

| Explosives | 3.10 | % | 4.7 | 2.50 | % | 4.8 | 0.22 | % |

| Others (Green Ammonia, etc.) | 1.21 | % | 1.8 | 5.21 | % | 9.9 | 18.49 | % |

By Technology Insights:

The Haber-Bosch Process segment led the ammonia market in 2024. Considered as a major industrial process, it uses catalyst to speed up the reaction between nitrogen and hydrogen to produce ammonia. The process is seen as a method that transformed entire agriculture sector by offering a reliable and efficient way to produce ammonia

The electrochemical segment is seen to grow at the fastest rate during the forecast period. Electrochemical sensors are more precise and safer than alternatives like catalytic or infrared sensors. Electrochemical ammonia production avoids high temperatures and pressures, opening doors for modular, distributed systems.

Ammonia Market Volume Share, By Technology, 2024 (%)

| By Technology | Volume Share, 2024 (%) | Market Volume- 2024 (Million Tons ) | Volume Share, 2034 (%) | Market Volume- 2034 (Million Tons ) | CAGR (2025 - 2034) | |||

| Haber-Bosch Process | 93.70 | % | 140.7 | 92.28 | % | 175.5 | 2.24 | % |

| Electrochemical | 0.50 | % | 0.8 | 2.50 | % | 4.8 | 20.28 | % |

| Partial Oxidation | 3.10 | % | 4.7 | 3.01 | % | 5.7 | 2.09 | % |

| Steam Reforming | 2.70 | % | 4.1 | 2.21 | % | 4.2 | 0.37 | % |

Top 10 Companies in the Ammonia Market and Their Contribution:

- Acron - A leading Russian ammonia and fertilizer producer, Acron operates high‑efficiency ammonia plants and exports globally to support sustainable crop yields.

- Koch Fertilizers, LLC - Koch leverages integrated natural‑gas methanol and ammonia facilities to offer competitively priced nitrogen fertilizer solutions across North America.

- Yara International - Yara trades roughly one‑third of the world’s ammonia, supplying multiple grades for agriculture and industrial use while pioneering green and blue ammonia projects (yara.com).

- CF Industries Holdings, Inc. - The world’s largest ammonia producer by volume (~10 M tpa), CF utilizes the Haber‑Bosch process and supports UAN, DEF, and emerging green ammonia initiatives .

- Nutrien Ltd. - Nutrien is developing what could become the world’s largest clean ammonia facility (1.2 M tpa) with over 90 % CO₂ capture to serve agriculture and energy markets .

- Qatar Fertiliser Company - QAFCO operates the world’s largest single‑site ammonia‑urea complex (2.0 M tpa ammonia), supplying global food and industrial sectors .

- Sumitomo Chemical Co., Ltd. - Sumitomo is partnering on blue and green ammonia development—collaborating with Yara to explore clean ammonia as feedstock and energy sources .

- Mitsui Chemicals, Inc. - Mitsui produces anhydrous and aqueous ammonia for NOₓ control, refrigerant use, and feedstock applications, while collaborating on clean ammonia stability efforts .

- BASF SE - BASF boasts ~1.4 M tpa ammonia capacity, offering biomass‑balanced ammonia and urea products—including low‑carbon AdBlue® and monomers for industrial use .

- Asahi Kasei Corp. - Rooted in ammonia chemistry since 1931, Asahi Kasei produces ammonia derivatives like nitric acid and provides ammonia for chemical and materials manufacturing .

What is Going Around The Globe?

-

In January 2025, SwitcH2 collaborated with the CorPower Ocean, for the development of renewable ammonia production facility with the capacity of 300,000 tons per year in area of northern Portugal. In these, ammonia production will be generated by a combination of solar, wave, and wind energy in the ground of CorPower’s technology.

Source:https://corpowerocean.com/switch2-and-corpower-ocean-partner-on-wave-powered-green-ammonia/

-

In March 2024, Yara, a global leader within the trade and shipping of ammonia, and GHC SAOC, a leading renewable energy firm in India, entered into a firm and binding long-term agreement for the ammonia supply with minimized CO2 emissions from Acme to Yara.

More Insights in Towards Chem and Materials:

- Fertilizers Market : The global fertilizers market volume reached 193.20 million tons in 2024 and is projected to hit around 262.18 million tons by 2034, expanding at a CAGR of 3.10% during the forecast period from 2025 to 2034.

- Phosphate Fertilizers Market : The global phosphate fertilizers market size is calculated at USD 70.11 billion in 2024, grew to USD 74.28 billion in 2025, and is projected to reach around USD 124.97 billion by 2034. The market is expanding at a CAGR of 5.95% between 2025 and 2034.

- Specialty Fertilizers Market ; The global specialty fertilizers market volume was reached at 30.23 million tons in 2024 and is expected to be worth around 49.33 million tons by 2034, exhibiting at a compound annual growth rate (CAGR) of 5.02% over the forecast period 2025 to 2034.

- Recycled Polyester Market : The global recycled polyester market size is calculated at USD 15.85 billion in 2024, grew to USD 17.32 billion in 2025 and is predicted to hit around USD 38.53 billion by 2034, expanding at healthy CAGR of 9.29% between 2025 and 2034.

- Ammonium Chloride Market : The global ammonium chloride market size is calculated at USD 2.3 billion in 2025 and is forecasted to reach around USD 3.52 billion by 2034, accelerating at a CAGR of 4.87% from 2025 to 2034.

- Renewable Natural Gas Market : The global renewable natural gas market size is calculated at USD 15.5 billion in 2025 and is forecasted to reach around USD 31.37 billion by 2034, accelerating at a CAGR of 8.15% from 2025 to 2034.

- Polyamide Market : The global polyamide market size accounted for USD 47.07 billion in 2025 and is forecasted to hit around USD 72.71 billion by 2034, representing a CAGR of 4.95% from 2025 to 2034.

- Chemical Intermediate Market: The global chemical intermediate market size is calculated at USD 118.19 billion in 2024, grew to USD 127.18 billion in 2025 and is predicted to hit around USD 246.1 billion by 2034, expanding at healthy CAGR of 7.61% between 2025 and 2034.

Elevate your Chemical strategy with Towards Chem and Materials. Enhance efficiency and achieve superior results - schedule a call today: https://www.towardschemandmaterials.com/schedule-meeting

Ammonia Market Top Key Companies:

- Acron

- Koch Fertilizers, LLC

- Yara International

- CF Industries Holdings, Inc.

- Nutrien Ltd.

- Qatar Fertiliser Company

- Togliattiazot

- SABIC

- Sumitomo Chemical Co., Ltd.

- Mitsui Chemicals, Inc.

- BASF SE

- Asahi Kasei Corp

Ammonia Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2034. For this study, Towards Chem and Materials has segmented the global Ammonia Market

By Form

- Anhydrous Ammonia

- Aqueous Ammonia

By Application

- Fertilizers

- Industrial Chemicals

- Refrigetation

- Textiles & Leather

- Pharmaceuticals

- Water & Wastewater Treatment

- Explosives

- Others (Green Ammonia, etc.)

By Technology

- Haber-Bosch Process

- Electrochemical

- Partial Oxidation

- Steam Reforming

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/price/5522

About Us

Towards Chem and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Chem and Materials | Towards Consumer Goods | Nova One Advisor |

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.